Table of Contents

The Avalanche blockchain is a PoS (Proof-of-Stake) Layer 0 network that has emerged as a close rival to Ethereum due to its scalability and low network fees. Widely perceived as a Layer 1 due to its smart contract capabilities, Avalanche allows for the creation of decentralised applications (dApps) as well as separate and interoperable blockchains within the ecosystem that can be custom-built for specific purposes.

Similar to ecosystems like Cosmos and Polkadot, Avalanche is based on the concept of an “Internet for Blockchains”, whereby unique blockchains are able to exist and communicate with one another under a single ecosystem – essentially the key to the mass adoption of blockchain technology.

However, it’s Avalanche’s significantly lower network fees and higher scalability (4,500 TPS compared to Ethereum’s 14 TPS) that makes it a better alternative to Ethereum as an ecosystem for DeFi.

Avalanche’s “C-Chain”, the network’s default smart contract blockchain, is also EVM (Ethereum Virtual Machine) compatible, which means that the ecosystem is fully compatible with Ethereum assets, applications (e.g. existing Ethereum DeFi protocols like Aave, Curve, and SushiSwap have all launched on Ethereum) and tooling, but with much higher throughput and lower fees.

Interoperability through subnets

The Avalanche ecosystem is made up of subnets – sets of validators working together to achieve consensus on the state of a set of blockchains. In simple terms, this means that each blockchain in Avalanche is “governed” by a group of supercomputers that are able validate the transactions on a blockchain. Imagine a group of managers in charge of a subsidiary that belongs to a parent company – that’s how subnets work.

For Avalanche, each blockchain (a “subsidiary” of Avalanche) is validated by a single subnet (a group of managers aka validators). A subnet can validate many blockchains. An individual validator (a “manager”) can also be a member of different subnets (different “managements”) to provide its validation service.

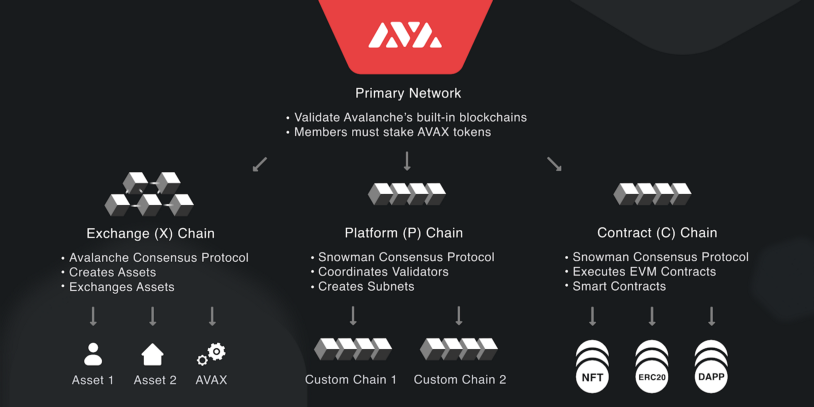

The core of Avalanche is made up of a subnet called the “Primary Network”. This subnet “manages” three native blockchains: The Exchange Chain (X-Chain), the Platform Chain (P-Chain), and the Contract Chain (C-Chain).

- The X-Chain is the blockchain used for creating, trading, and exchanging crypto assets such as AVAX. This means that its sole purpose is to send and receive funds (not for DeFi platforms).

- The P-Chain allows users to stake their AVAX and serve as a validator. This means that AVAX rewards for validators will be received on this chain.

- The C-Chain facilitates the creation of smart contracts. It’s also the blockchain for DeFi apps. Unlike the X-Chain which is not MetaMask compatible and can only be accessed from the Avalanche Web Wallet, the C-Chain uses an Ethereum-style address with “0x” at the beginning, which can be added to a user’s MetaMask (or similar DeFi wallets).

In terms of the wider applications of subnets, they essentially allow anyone to develop and manage their own Layer 1 application-specific blockchain on Avalanche. This is especially powerful because unlike Ethereum where dApps (e.g. DeFi protocols) are deployed on a single blockchain which increases congestion and network fees, subnets allow dApps to have their own blockchains. It’s just like sharding in Ethereum 2.0, but instead of just transactions being processed in parallel, different applications each with their own customised blockchains can coexist and interoperate without directly competing with one another and driving up network fees.

Subnet creation is also unlimited, which means that Avalanche’s 4,500 TPS (already twice that of Visa), can theoretically be expanded to accommodate more transactions. Private subnets can also be developed, whereby only selected validators who have completed KYC/AML screenings can view and validate the transactions on those private blockchains. This is especially ideal for organisations keen on building within the Avalanche ecosystem, but also intend to keep their information confidential. This means that Avalanche can be a network for public dApps as well as for private organisations. However, all validators must also validate the Primary Network (by staking 2,000 AVAX) for the entire duration that they validate a subnet.

“Subnets are powerful, reliable and secure private or public blockchains built as offshoots to the core Avalanche platform,” said John Wu, president of Ava Labs, in an interview with CNBC. “Developers of these custom blockchains have complete control over the design, with the only requirement being to participate in securing the core platform.

An “Ethereum killer”?

Avalanche has been dubbed by many as an “Ethereum killer” and for good reason. The blockchain is currently one of the fastest time to finality (the time taken for a transaction to process and be considered permanent and irreversible) networks on the market. Avalanche achieves finality in less than a second, while close rivals Solana and Ethereum take approximately 13 seconds and 1 minute respectively, making Avalanche a much better ecosystem for DeFi transactions.

The network is also interoperable with Ethereum (this is in addition to being EVM compatible) via the recently launched Avalanche Bridge, which enables the transfer of ERC-20 tokens (fungible tokens) and ERC-721 tokens (non-fungible tokens) between Avalanche and Ethereum. Considering the fact that nearly 60% of all dApps exist on Ethereum and that the network has a total TVL (total value locked) of more than US$100 billion, interoperability with Ethereum will likely enhance Avalanche’s reputation as an “Ethereum killer” and encourage more users and developers to use the network, especially given the fact that Ethereum 2.0’s upgrades have been delayed again.

At the time of publication, AVAX is trading at US$66.97, growing 160% YTD and peaking at US$134 in December 2021. As interest in DeFi increases and the need for cross-chain interoperability becomes more apparent in Web 3.0, Avalanche is a viable ecosystem that investors, DeFi developers, and Web3 enthusiasts should keep an eye on.