Table of Contents

Coinbase has posted its first quarterly profit since 2021, according to its most recent earnings report, released Thursday.

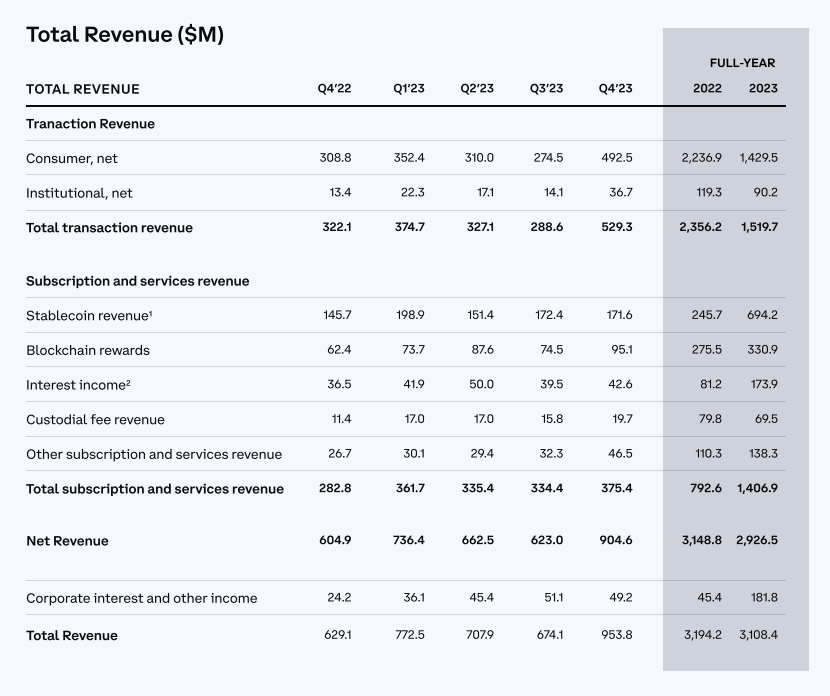

Revenue of $953.8 million exceeded analysts' forecast of $826.1 million, sending the crypto exchange's stock price up nearly 13% after the bell, marking a 150% increase in the last 12 months.

Trading volume on Coinbase more than doubled to $154 billion from the last quarter, superceding analysts' expectations of $142.7 billion.

Coinbase expects to generate $410 million to $480 million in subscription and service revenue in the first quarter of 2024.

"We’re really pleased with the results,” Anil Gupta, vice president of investor relations at Coinbase told CoinDesk. “Operational rigor that we set forth early in the year really paid off over the course of 2023.”

Coinbase's earnings growth comes amid a raging bull market with Bitcoin clearing the $50K mark on the back of the SEC's Bitcoin ETF approvals. Trading platform Robinhood also recently reported crypto revenue of $43 million, boosting its overall transaction-based revenue up 8% year-over-year to $200 million.

Gupta revealed that the ETF win for the industry is also a win for the exchange. "The ETFs are really a win-win for Coinbase, I think we’re already starting to see that play out on the platform,” Gupta said. The crypto exchange provides custodial services to 8 out of the ten spot bitcoin ETFs, making it a key player in the business.

"Custody is obviously a relatively small part of the business today but the great news about ETFs is that it’s invigorating the entire sector … so you’re seeing a lot of activity and engagement on the platform,” he said.

CFO Alesia Haas echoed a similar message, stating, "ETFs have just been net positive for the industry and additive to Coinbase."

Investors believe Bitcoin ETFs will attract more institutional money into the crypto industry. In Q4, Coinbase's consumer transaction revenue increased 79% from the previous quarter but institutional transaction revenue jumped 161% over the same period.

Earlier this month, Coinbase announced a fee slash to attract traders who deal in high volumes to boost its institutional business. The exchange is waiving fees for 60 days for Coinbase Advanced customers trading crypto on its professional market if they have traded over $500,000 per month on a rival exchange.

"We know that fees are one of the most important factors when it comes to selecting and trading on a crypto exchange," the exchange said. "To better serve advanced traders, we are establishing a new fee tier upgrade program for Coinbase Advanced."

Even JP Morgan, which has notoriously taken a sceptical view of the crypto industry, upgraded Coinbase stock to "Neutral" from "Underweight" ahead of its earnings report, citing rising prices of Bitcoin and other cryptocurrencies.

“We see the higher cryptocurrency prices not only sustaining, but improving, activity levels and Coinbase’s earnings power as we look to 1Q24,” the analysts wrote.